Similar to other countries, meat consumption in India has increased with rising incomes. Unfortunately, this consumption comes with its own cost namely environmental, animal welfare, and human health. A sustainable alternative with a similar taste and experience can help replace non-sustainable traditional animal-based meat. A large R&D effort is making plant-based meat an almost perfect replacement for its animal-based counterparts.

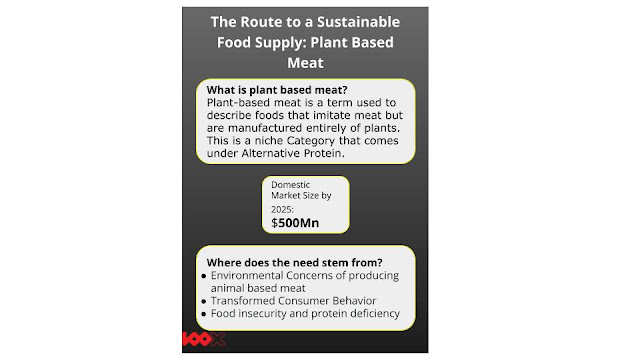

Plant-based meat is a niche category that comes under alternative protein and imitates its animal-based counterparts. The latest technological developments in food have made it possible for companies to produce meatless meat. The journey starts from deep R&D which sometimes takes a couple of months to yield results. There is no one way to make plant-based meat. It depends on which counterpart one is trying to replicate - Is it a steak, usual chicken nuggets, or a slice of pork? Some are easier to produce than others. The basic components - proteins, vitamins, fats, and minerals are shared by both animals and plants. One just needs to work on the correct experience including taste and texture to make faux meat from plant products. The star raw ingredients include soy, wheat, pea, quinoa, etc.

The need for plant-based meat products stems from certain factors - transformed consumer behavior, environmental concerns, health. Out of these, the most significant bucket to consider is environmental factors. According to GFI, Animal agriculture takes up 77% of all agricultural land on Earth despite supplying only 17% of humanity’s food supply. This land can alternatively be used for growing crops that can be used to feed many more people and to eliminate prevalent world hunger. Increasing awareness in modern consumers is an important driver. It uses 72-99% less water and emits 30%–90% less greenhouse gas than conventional meat.

The other factor that comes to play is transforming consumer behavior due to increasing awareness about its environmental cost and health concerns. According to reports, 54 percent of early adopters in India are familiar with plant-based meat. Nearly 80 percent are interested in trying it. Additionally, When nutritional qualities are compared, plant-based meats are demonstrably healthier than animal-based meat. Plant-based meat is high in fiber and complex carbohydrates, whereas animal-based meat is low in both. However, there are concerns around plant-based meat being ultra-processed (most of the time) which induces debate for it being a healthier option.

The domestic market is still at a nascent stage with a market size of only $40-50 Mn while the global market size is around $5.6 Bn. Consumer packaged products - Frozen Category mainly has a larger share in the domestic demand. Some reports indicate that India will witness exponential demand up to $500 mn by 2025. Here, it is critical to understand that very few consumers will shift entirely to plant-based while the majority will still be consuming both depending upon factors like occasion, type of meat dish they want to experience, etc. For instance, hardcore meat-eaters would only want to eat butter chicken obtained from an animal while they would be fine having faux meat wrapped in a Frankie.

It is imperative to assess if the consumers are really interested in adopting a plant-based substitute. According to GFI, once a consumer's basic drivers of taste, cost, and convenience are met, they can start making choices that align with higher, more aspirational values, such as health, environmental impact, and animal welfare. To put it another way, only when consumers perceive a food product to be delicious, affordable, and accessible will they consider its health benefits, environmental impact, or impact on animals. Companies operating in this space have been trying to replicate the taste and experience but as far as affordability is concerned, it needs to be resolved in the coming years through the development of efficient processes and economies of scale. The consumption of plant-based meat is not just a metro phenomenon; consumers in India's interior are also open to trying these products and are repeating the purchase. Through its distributors, Goodot, one of the major Indian players, says that they are seeing adoption and repeat purchases of plant-based meat in tier 2 and 3 cities.

The Industry gross margins are quite attractive at 30-50% (leaving the extreme values) for both retail and QSR segments. Investment is high in cases where a company is spending its resources on R&D and further needs funds to commercialize. However, the majority of companies are grossly into spending on mere processing rather than R&D. This method might not need a large amount of funding but it will find it difficult to serve its customer with the real meat experience. India has fewer players in the market serving just simple products and is not as impressive as some international players like Beyond Meat or Impossible Foods. In order to meet the domestic demand predicted for 2024, we need more players with products at or above par. Moreover, the frozen category needs an efficient cold supply chain which becomes another issue for Indian startups.

The Indian investment landscape to support early-stage alternative protein is not very impressive as there is a huge gestation period when a company develops its product from scratch and takes several years just to experiment. This environment is slowly changing with some investors considering impact and sustainability into their investment thesis. ESG investing while taking care of the business opportunity can yield far more good results in the long run.

Now, a very important question arises here - What should the investors look for while investing in a plant-based meat opportunity? The unique experience and knowledge of the founding team are critical to the success of any venture. It’s essential that the founders have some experience in creating such innovative products or have done enough research to pursue this opportunity. The other important factor to consider is the brand’s focus on localization. For instance, an Indian is looking to experience Afghani kebab by replacing it with plant-based while an American wants his/her country meat dish to be replaced with plant-based. Serving both domestic and international markets with the same product doesn’t seem to be the right strategy unless there is a special case of serving Indian delicacies to foreign countries. If a company is catering to the Indian market, it should localize the taste accordingly. However, if they are exporting products, the taste should be modified according to the geography. If the products are already launched in the market, they should have received some early product-market fit which helps to gauge consumer interest in the product. This sometimes would not hold true for the products still at the stage of experimentation.

A major concern around plant-based meat is its price. Although plant-based meat is expensive today, as it scales up, the price will fall, and eventually, in the not-too-distant future, it will be more affordable than animal-based meat. The infancy of the domestic market has driven many startups to move to export products. This is a good strategy for those who are looking to benefit from the surge in global demand, However, it might conflict with the aim of promoting sustainability when one takes into account the food miles.

Trends come and go, but this movement aimed at food sustainability will endure. It has become easier to make people aware of such trends due to ever-increasing internet penetration, however certain challenges related to product and demand-side (willingness and ability) still lie ahead of these startups. Food companies, food service providers, governments, and environmentalists can all help to speed up the transition to a more sustainable food system.

100X.VC is the first VC to invest in early stage startups using India SAFE Notes. We fund exceptional Indian founders. We deeply value our relationships with founders, co-investors, and corporations.

This article is by 100X.VC Research with contributions made by Mansha Gadi, Analyst Trainee at 100X.VC