Venture Capital is Not for everyone

Startup founders get passed on consistently by venture capitalists - and they keep asking why. The business may be running well, they may be making profits, they may be showing significant growth - and yet? Does this sound familiar to you?

Sometimes, it’s just because the startup may not be venture fundable. While Venture Capital is one of the most publicised way of financing new businesses, it’s not the only one. And, it’s not a good fit for all kinds of businesses. I’m writing this blog to help founders evaluate and introspect if their business is venture backable.

Understanding Venture Economics

Let’s take a rudimentary example of a non-existent fund PQR Ventures of ₹100Cr. Portfolio Construction is not as simple as I’m stating, but let’s say they intend to invest ₹5Cr in 20 Companies. A good return would be turning the 100Cr into a 300Cr return to LPs. Here’s how the return profile might generally look:

| Average Return Multiple | Number of Startups | Value Returned |

| 0x | 5 | 0 |

| 1x | 10 | 50 |

| 3x | 3 | 45 |

As you can see, 18 Startups have returned about 95Cr. The remaining 2 startups will have to now return ~205Cr, i.e. both will have to return a 20X each. Or, 1 will have to return a 40X.

Venture Economics have a lot more nuance obviously, but this broadly sums it up.

Every VC invests only if they see the possibility of the company being a multibagger. If it does not have a shot at being humongous, VCs can not afford to invest in it.

The Only Formula you Need to Know

The Other thing that matters to VCs is Growth in value as a function of Capital Invested

f(x) = ex

Let's break this down.

- “X” here is the capital invested in the business.

- F(x) is the value created by the Business

- It is important to Note that Value is not always only connected to revenue. It is connected to Brand, to Growth, to Usage, Cashflows, Profitability, Moat and a lot more!

The Formula ex when plotted looks as below:

Venture Backable Businesses Create Value Exponentially as a function of Capital Infused

Put simply, VCs ask :

- “Can this company consume capital, lead to Value creation beyond what the capital invested would generally create?” and

“Can it keep consuming capital - external and their own - and keep increasing the value?”

How to Evaluate if you're Venture Fundable

Now we know, there are two factors that matter to VCs:

- A multi-bagger return opportunity

- Value created as an exponential function of the capital invested

At the early stage, there are generally 4 items that investors look at:

- Market

- Team

- Product

- Business Model

Let's break each one down and see how they tie into the two key factors

Is my Market Venture Fundable?

The questions that VCs will try to get answers to are:

Question 1: Is it a large Market?

If it isn't, how will the opportunity ever be a multi-bagger? If the opportunity isn't a multi-bagger, you're violating Rule 1, and you'll probably get passed on. A $10Mn with a 100% Monopoly for you is still only a $10Mn market. A $10Bn Market with 1% penetration from you is a $100Mn opportunity for you.

Question 2: How Fast is it Growing?

A shrinking Market is an absolute no. If your market opportunity is growing then the rate matters subjective to the size of the market. A $500Mn market doubling every year is far more attractive thana $1Bn Market growing at 10% a year. The room to grow also matters. If the market has plateaud, There isn't much space to grown. The other alternative is to have a business model that actually grows the market.

Question 3: Are there already incumbents with Pole Position?

Is this market already taken? If Zomato and Swiggy have already taken up the food delivery market, it's going to be tough to win against their progress, traction, and war chest. If this is your case, you must show to the VC you are 10x better than the existing options, and have the ability to disrupt all pole position players. Incremental Innovation rarely gets funded in such market

Is my Product Venture Backable?

Question 1: Can you produce the product / service at scale?

If each unit of the product needs you to manually build it, how will you produce it at scale? You can scale demand, but how will you scale supply? How will you scale yourself?

This is one reason service businesses are tough to back through venture. Productising Services at scale is a table stakes for such businesses.

Question 2: Can you distribute the product / service at scale?

Does your product need -100 Celsius packaging to be transported? Is your Software only replicable by going and installing it on the company's servers manually? Is your target customer in remote places where you have to send agents to sell? A product that can distributed well makes it easier to be venture backable.

Question 3: Is it a Commodity?

If your product is fungible in the buyer / users mind with any other product, you are bound to be replaced eventually, or get into a pricing war. VCs like to see products which can create a moat for themselves and differentiate them from other me toos.

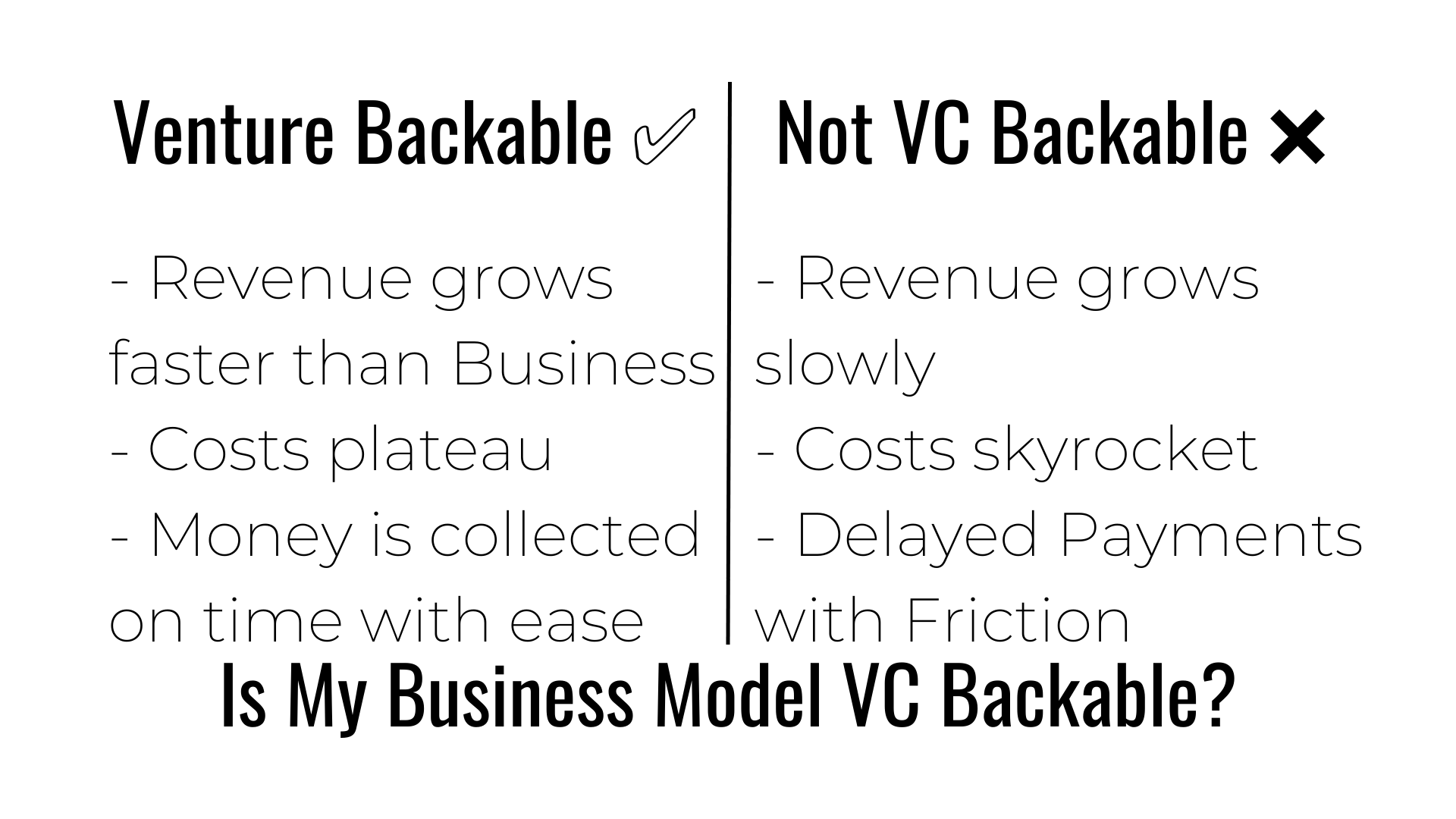

Is my Business Model Venture Backable?

Question 1: Does Revenue scale exponentially with Business?

You may have users, but they're not worth much if you can't make money off them. Not only should users lead to revenue, but it's important to see if a) as the number of users grow, the revenue grows and b) Over time, users start becoming power users and pay more for the product than they were earlier.

Question 2: Do the Costs stay linear while Revenue Scales exponentially?

A business where you have to spend $1 to make $2 and $10M to make $20M wouldn't be very scalable. Even worse, would be Spending $10M to make $1M at scale. The Costs should grow linearly while the revenue grows exponentially.

Question 3: Can I Collect Money in a scalable Exponential Manner?

Many founders take this for granted, but this is very critical to a business' health, as it defines the cashflow. If credit cycles in your business last 90 days, it's gonna be tough to keep the company liquid. If you have to send feet on street to collect payments, the economics just don't scale. Time to Money is crucial for businesses

Is My Team Venture Backable?

In the end, Investors are trying to understand one thing - Is this the team that makes me money? Here's how they understand the same:

Question 1: Are the key, table-stakes skills in the team?

Every business has some things which are table stakes - bare minimum things that need to be done in order to be competitive in the market. A startup team which doesn't have the basic skills to build product that can compete in the market is not venture backable. Build a team that has the skills to build and sell, and earn a seat at the table.

Question 2: Do the Founders understand the market?

Founders' Pedigree in understanding the market can be defined through 3 E's : Education, Experience, and Experimentation. Have a clear understanding of the competitive landscape, your target persona, the revenue opportunity. Understand the behaviour of your buyers and users as if you were a fly on their wall.

Question 3: Do the founders know how to execute?

This one goes without saying - a team with the most well fleshed out idea, but no intent to execute is not fundable. Action speaks louder than words.

Conclusion

So that's how VCs gauge if an opportunity is venture backable. If you are venture backable, use these tips to shape your narrative. Highlight how you are venture backable.

At 100X.VC, we work closely with founders to help them build the right narrative for the next rounds. If you'd like to work with us, reach out to us at www.100x.vc/class08