Introduction

The days of people relying on traditional payment methods like cash and checks are long gone. Computers and mobile phones have transformed not only the way we work but also how we manage our finances and payments. The emergence of modern services, such as e-commerce, has resulted in a desire for faster payment methods, thanks to the ever-changing and expanding technology. Regrettably, traditional payment methods, which were increasing slowly, were unable to match the demand for new payment systems. As a result, new digital payment systems are on the rise.

During the financial year (FY) 2021-2022, the volume of digital payments in India increased by 33% year on year (YoY). According to the Ministry of Electronics and Information Technology (MeitY), there were 7,422 crore digital payment transactions in FY 2020-21, up from 5,554 crores in FY 2020-21. But, with great digitization comes great risk of digital fraud. 50% of all financial services frauds are carried out via UPI. Every month, 80,000 frauds worth Rs 200 crore ($ 26.8 million) are carried out through UPI. 46% of consumers who purchased a product through social media sites reported fraudulent activity of some kind.

Consumers in India are accustomed to paying cash on delivery, and retailers do not want to ship goods unless money is received to avoid returns. Buyers are looking for Security and Safety of Money, Quick and Hassle free Refunds, and equal rights throughout the transaction. Whereas sellers want guarantee of payment, increased credibility that would lead to increased conversions.

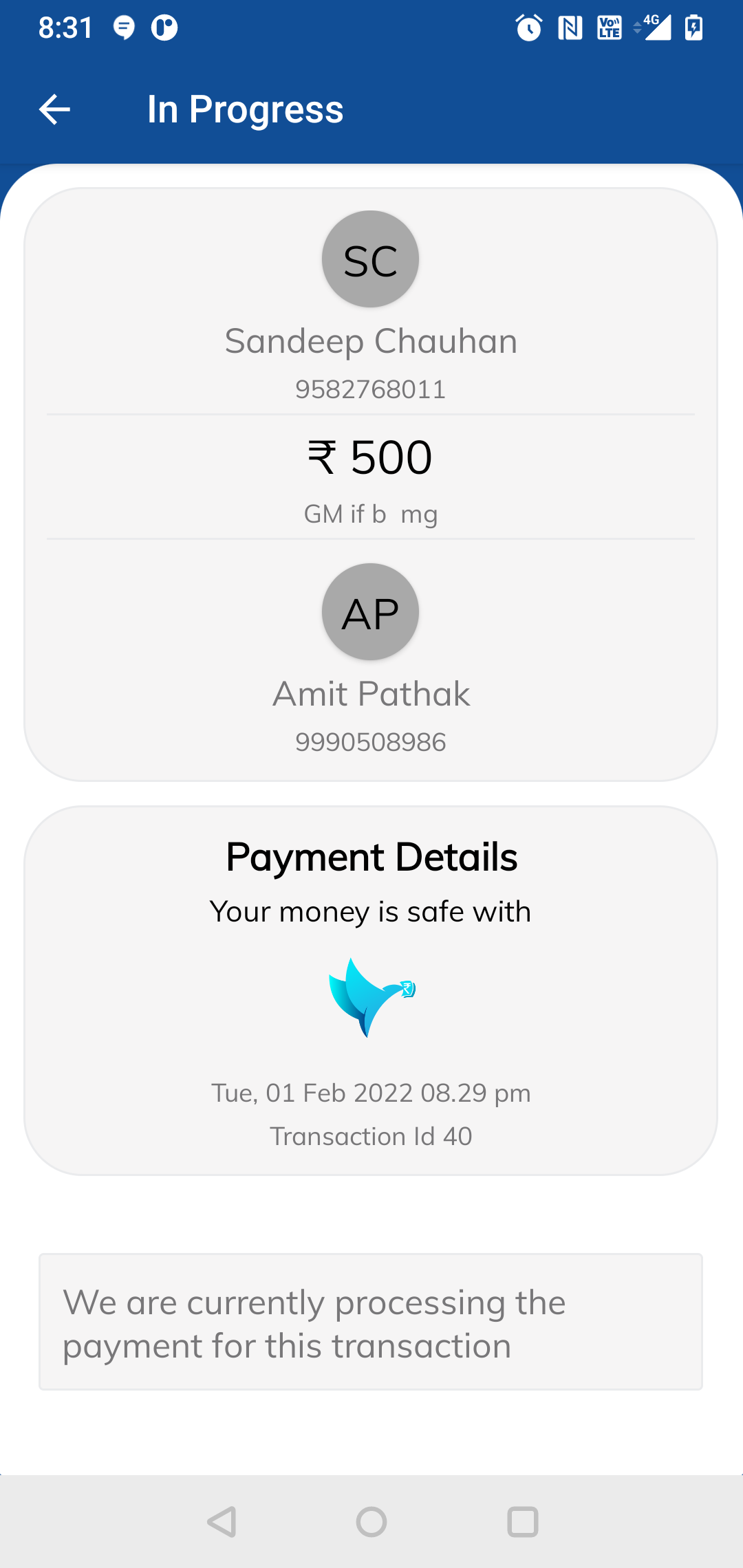

GoCrow bridges the trust gap in digital transactions. It is a safe and secure payment platform that facilitates escrow-based payments. It empowers daily transactions without the fear of losing money. It's a platform upon which the creative economy would thrive upon. As Instagram and social commerce become more popular, there is a need to connect consumers with businesses, allowing them to execute transactions quickly and securely. Consumers and merchants may track and exchange real-time payment and delivery information.

GoCrow is co-founded by 2 colleagues at OLX, Rahul, Sandeep, and his roommate Kartikey. Sandeep and Kartikey faced this issue by themselves and started working towards GoCrow. Post that they pitched to Rahul and being best friends and super supportive colleagues, they joined in as Co-founders of GoCrow.

Market Opportunity

The popularity of various payment gateways in India is expanding due to the rise in e-commerce transactions. The Indian e-commerce business has been on an upward growth trend, according to the Indian Brand Equity Foundation, and is predicted to surpass the United States to become the world's second-largest e-commerce market by 2034. By 2020, the e-commerce market is predicted to be worth USD 64 billion, and by 2026, it will be worth USD 200 billion. According to the Reserve Bank of India, UPI transactions for retail payments in April 2020 exceeded INR 1511 billion. Social commerce industry is projected to be INR 1,350 Cr ($18 Bn) growing at a CAGR of 65%

100X.VC Thesis

For online purchases, esp in the individual retail segment , there is a certain lack of trust between the buyer and the seller. Also, there must be no friction in the payment process. The key to making secure hassle free purchases (without the trust factor) is to use an Escrow service, which GoCrow does. It guarantees a low-cost solution, simplified sales processes, decreased risk, protection for both parties, and suitability for a wide range of items. This, according to 100X.VC, is an exception in the increasing needs for businesses which are increasingly beginning to go online.

Conclusion

With the team and the product, GoCrow can prove to be an excellent platform for consumers. A credible and trust-worthy payment system was called for to address the issue of safety of money and protect the benefits of both parties in a transaction. We wish the team all the very best!